When debt isn’t holding you back, nothing can stop you from living the life of your dreams (yeah, that one you’re thinking about right now). And here’s the good news: You can get there. You just need a plan that works.

That’s what you’ll learn in Financial Peace University. FPU is the nine-week class that teaches you step by step how to pay off debt fast and build wealth for your future.

Stuffy financial class? Not here. FPU is full of energy, easy-to-understand lessons, and real-life examples of people just like you who have taken control of their money.

And the best part? You’ll experience the class with a group of people who will encourage you and hold you accountable every step of the way. That’s what makes FPU so life-changing! In fact, the average FPU graduate is debt-free in two years or less!

Dave Ramsey’s been teaching commonsense, biblical money principles for almost 30 years. And they work. Every time. Just ask the nearly 10 million people who’ve taken FPU and never have to worry about money again.

You’re next. Ready?

In Financial Peace University, you’ll learn how to:

- Take control of your money

- Attack debt with a vengeance and pay it off fast

- Save for emergencies

- Choose the right insurance plans

- Invest wisely and build wealth

- Give generously (the best part)

What you get with FPU:

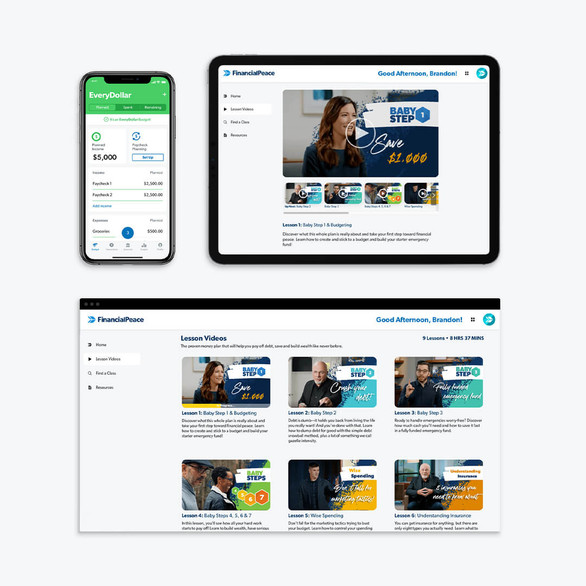

- The ability to join any in-person or virtual class

- One year of access to all nine video lessons

- Three months of premium access to the EveryDollar budgeting app

- One year of group financial coaching

- A free one-on-one financial coaching session

- Fully editable digital workbook (with the option to purchase a hardcover workbook—for all you pen-and-paper folks)

Financial Peace University will be delivered digitally. You (or your gift recipient) will receive an email confirming your purchase, as well as a second email with instructions on activating your FPU account.

Note: Currently, Financial Peace University cannot be purchased or supported outside the U.S.

- Audience:

- For Individuals